Most people considering filing bankruptcy are convinced that they’ll never be able to borrow money again.

This is absolutely false. Bankruptcy filers see an immediate positive impact on their credit score from a bankruptcy discharge.

What happens to my credit score after bankruptcy?

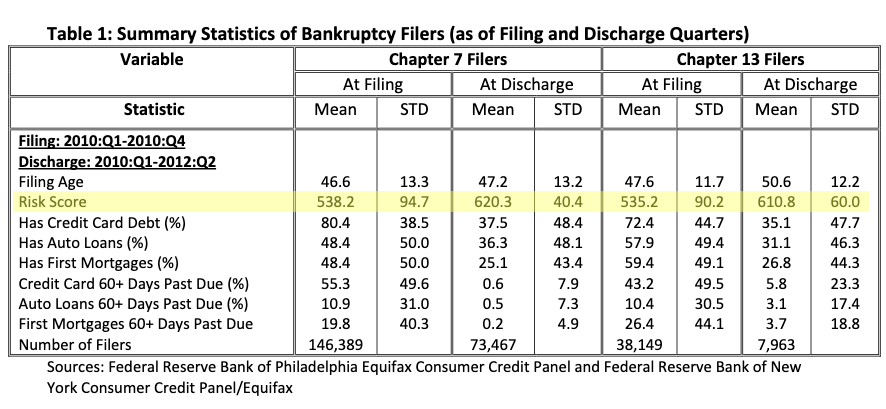

I’ll say this loud, for the people in the back: filing bankruptcy does not forever destroy your credit. In fact, empirical research over 10 years illustrates just the opposite – an 80 point credit score boost upon discharge. See chart below.

This data comes from the largest study to shed new light on credit availability to consumer bankruptcy filers, published by the Federal Reserve Bank on August 7, 2014.

Using a nationwide sample of 12 million debtors who filed for bankruptcy from 2002 to 2013, the authors were able to demonstrate that the average debtor’s credit score increased by 80 points due to the bankruptcy filing, from a 538 pre-bankruptcy credit score to 620 post-bankruptcy credit score.

The results illustrated that:

1. Bankruptcy filers have much higher credit scores at discharge than at filing;

2. Bankruptcy filers were completely rehabilitated and regained full access to the credit market shortly after the bankruptcy filing;

3. Both Chapter 7 and Chapter 13 filers were able to get new credit cards almost right after their bankruptcy filing;

4. Both Chapter 7 and Chapter 13 filers were granted access to new credit cards and new car loans within 60 days of their discharge date.

Immediately after filing, you’ll have a harder time borrowing the amounts you used to be able to. You’ll pay more in interest. But credit is available.

The farther in the past your bankruptcy becomes, the easier it is to get credit, even though it stays on your credit report for ten years. You might even be a better credit risk right after filing bankruptcy than you were before since your debt-to-income ratio will be better after your discharge.

If you wait three years after your discharge to apply for a mortgage, you will find that you are eligible for the same loan terms as similar borrowers who have not filed bankruptcy. When evaluating you as a mortgage candidate, lenders will pay more attention to the size of your down payment and the stability of your income than the fact that you once filed bankruptcy.

While landlords and credit card companies are within their rights to consider your past bankruptcy when making a credit decision, you are protected from employment discrimination based solely on your financial history.

Want to talk through what your credit future could look like after bankruptcy?

It’s free to chat with me about your options – you can call or text me at 215.551.7109, or drop me a line.