Erasing Student Loans

99.9% of bankruptcy student loan debtors don’t even try to discharge their student loans because they mistakenly think that student loans cannot be discharged.

Can Student Loans be Erased? YES, YES, YES.

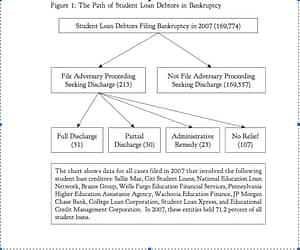

A recent study conducted by Jason Iuliano, a Harvard Law graduate and a Ph. D. candidate at Princeton revealed that 40% of filers with large student loan debt received some form of discharge from the bankruptcy court when they filed an adversary proceeding seeking a discharge of their student loans. An adversary proceeding is a lawsuit within a bankruptcy case asking the bankruptcy judge for an order to erase the student loans.

The 2012 study reviewed 169,774 student loan debtors filing bankruptcy, and found that only 217 debtors filed adversary proceedings, a necessary step to discharge student loans.

Results of the 217 adversary proceedings:

- 56 received a settlement with their student loan creditors (39%)

- 51 received a full discharge (25%)

- 30 received a partial discharge (14%)

- 25 received an administrative repayment plan (12%)

“You must unlearn what you have learned.” – Yoda

Here is the article:

Author: Jason Iuliano

Harvard Law graduate and Ph. D. candidate at Princeton

Princeton University, Woodrow Wilson School of Public and International Affairs

Cite: 86 American Bankruptcy Law Journal 495 (2012)

Date: September 25, 2012

Website: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1894445